|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding VA Mortgage Rates for Cash-Out Refinance OptionsIntroduction to VA Cash-Out RefinanceThe VA cash-out refinance program is a powerful tool for veterans and active-duty service members. It allows borrowers to replace their current mortgage with a new VA loan, often with better terms, while also taking out cash from their home equity. Benefits of VA Cash-Out Refinance

Eligibility RequirementsTo qualify, you must have sufficient entitlement, meet credit and income requirements, and occupy the home as your primary residence. Understanding your eligibility can streamline the process. Current VA Mortgage RatesVA mortgage rates for cash-out refinance vary based on market conditions, credit score, and loan amount. Regularly checking current rates can help you decide the best time to refinance. Consider using a refinance mortgage and heloc calculator to compare potential savings and costs. Factors Influencing Rates

Uses of Cash-Out Refinance FundsThe funds from a cash-out refinance can be used for various purposes, such as home improvements, debt consolidation, or education expenses. It's crucial to ensure the funds are used in a way that enhances your financial health. If you're considering a major renovation, learn more about how to refinance mortgage for home addition projects. Frequently Asked QuestionsWhat is the maximum amount I can cash out with a VA refinance?The maximum cash-out amount depends on your home’s current market value and the remaining balance on your existing mortgage. Typically, you can refinance up to 100% of your home’s value. Are there any fees associated with a VA cash-out refinance?Yes, there are costs such as closing costs and a funding fee, which varies based on the loan amount and your veteran status. Some lenders may offer options to roll these fees into the new loan. How long does the VA cash-out refinance process take?The process typically takes 30 to 45 days, but this can vary based on lender efficiency and your financial situation. https://www.va.gov/housing-assistance/home-loans/loan-types/cash-out-loan/

A VA-backed cash-out refinance loan lets you replace your current loan with a new one under different terms. If you want to take cash out of ... https://www.pennymac.com/refinancing-products/va-cash-out-refinance

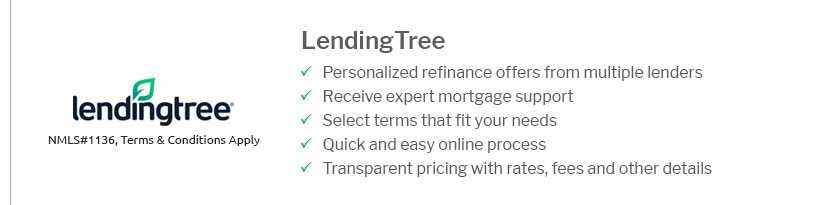

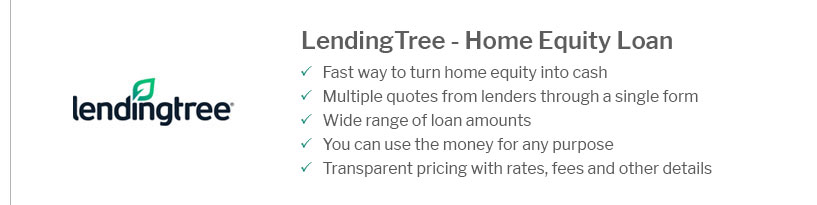

Veterans who would like to refinance their mortgages into a low rate while getting cash out of the equity in their homes may be eligible for the VA's Cash-Out ... https://www.lendingtree.com/home/mortgage/va-cash-out-refinance/

The rate for a 30-year VA cash-out refinance loan is 6.63% as of Dec. 12, 2024. Since VA mortgages are government-backed loans, rates are ...

|

|---|